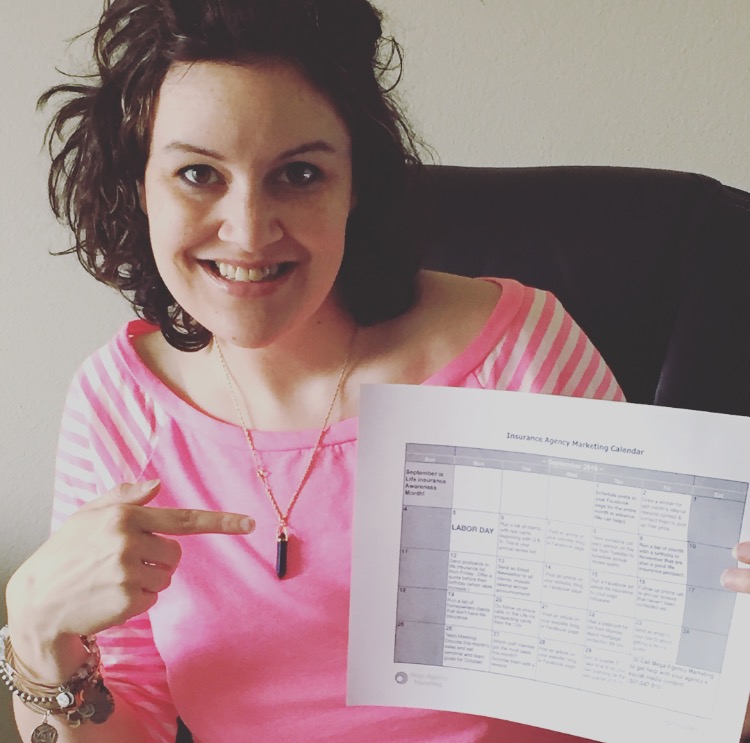

When people ask me how to sell more Life Insurance to their auto & home clients, I ALWAYS recommend that they use my Life Birthday campaign. It’s super easy, can be run all year long (generating consistent leads), and has a strong, motivating, call-to-action.

The Life Birthday Campaign: Here’s The Campaign

WHO TO TARGET: Current auto/home clients that don’t have life insurance with you. (Some people also target by age, marital status, if clients have children, etc. Do as needed to get the best result!)

WHO TO TARGET: Current auto/home clients that don’t have life insurance with you. (Some people also target by age, marital status, if clients have children, etc. Do as needed to get the best result!)

Now divide up that list of clients by their birthdates. Remember, life insurance rates increase on your birthday, right? So there is a clear incentive to lock in the rate before you turn a year older.

We’re going to capitalize on that by marketing heavily to clients right BEFORE their birthday. I usually recommend aiming about two months out to start this campaign. (That gives you enough time to market, quote, follow up and close without being too rushed.)

Once you know who to target and when, you’ll create the marketing pieces and plan out a schedule to send it and follow up.

I like to warm prospects up with a postcard first. Most people aren’t going to call from the card alone, BUT that doesn’t mean it won’t get them thinking about it. Explain that if they don’t lock the current rate in soon, life insurance is going to cost more after their birthday!

Note…please don’t put this in a birthday card. No one wants a birthday card that says “Happy Birthday, you’re one year closer to death!” Nothing positive will come of this!

Note…please don’t put this in a birthday card. No one wants a birthday card that says “Happy Birthday, you’re one year closer to death!” Nothing positive will come of this!

You’ll want to send your postcard and follow up a few days later with a phone call. The call is designed to follow up on the card! Some of you will want to do a quote over the phone immediately, others may be more focused on setting an appointment. Whatever works for you. (Make sure to have a plan for voicemail too. You know that you’re going to be leaving a few!)

Other Ways To Follow Up

Consider increasing your message by using a targeted Facebook ad. I LOVE that you can create a custom audience on Facebook and only show your ad to specific people. That means you upload your list of postcard recipients and they’re the ONLY ones who see your ad!

Create your Facebook ad and try to use the same message (and even image) as what you used on the postcard. It keeps the message strong and will increase your response.

If Facebook ads aren’t for you (why not???), just stick to good old email. Send an email a few days after your calls and follow up with those clients again.

Rinse and Repeat

If you’ve got time, keep the process going up until their birthday. But here’s the great part…you get to start all over again next month with a new list of people! It’s truly the marketing campaign that keeps on giving.

If you’ve got time, keep the process going up until their birthday. But here’s the great part…you get to start all over again next month with a new list of people! It’s truly the marketing campaign that keeps on giving.

Success Tip

Remember, the key to making this work is making it really clear that the price is INCREASING. If I told you that those golf clubs you’ve been eyeing for six months are about to get more expensive, you’re going to jump on the good deal NOW. If you know that house is in a great neighborhood and will go above market value, you put in your offer NOW. It’s how we’re wired. We’re going to take action only when forced and probably up until the very last minute. So don’t give up on those clients.

Consider a quick “last minute” phone call or email one week before their birthday as the VERY last chance to lock in that rate. I bet you get at LEAST one more lead just for doing that.

Ready To Implement?

I’ve put together ALL of the marketing materials for this campaign and packaged them up in the Life Sales Mastery course. It’s got the postcard, phone scripts, Facebook ad, email template, and campaign schedule all ready to go. (Plus much, much more to improve your life insurance sales.) Get all the details here!

Consistent marketing means consistent leads! Implement this campaign today and start selling life insurance each and every month, all year long, to your P&C clients.